Partial Disposition Roof Replacement

She replaces the roof which is a structural component.

Partial disposition roof replacement. By providing basic data the calculator provides a ppi adjusted value while considering the condition of the respective component at the time it was acquired accomplished by considering the component s normal life. For example a loss could not be recognized when an old roof was disposed and replaced with a new roof. We have national coverage in that we can do a cost segregation study on any building in the us. Free partial asset disposition calculations for as long as you own the building when the property owner completes a cost segregation study through carrara business services.

Certain betterments restorations or adaptations to property can provide you with a tax opportunity to do a partial disposition of the old property and capitalize the new property. Dispose of the old and capitalize the new let s say that you ve replaced the roof on your rental property. How to calculate partial dispositions. Calculating partial asset.

The election is made by reporting the gain or loss on a timely filed original tax return including extensions for the tax year in which the portion of. An this can result in still other tax advantages. But a late partial disposition lets you write off an old roof you replaced in say 2012 on the 2014 tax return. The accounting mechanics work the same for a late partial election.

In other words a current partial disposition lets you write off an old roof you replaced in 2014 on the 2014 tax return. Renovation or remodeling projects that give rise to significant partial disposition losses and removal cost deductions often are multimonth or even multiyear projects and demolition of the existing property generally is completed early or at the very beginning of the project. 1 168 i 8 d 2 ii b explains the manner of making the election is by reporting the gain loss or other deduction on the taxpayer s timely filed original return for the year the partial disposition is made and by classifying the replacement portion of the asset under the same asset class as the disposed portion of the asset in the year. Alice may not recognize a loss and must continue to depreciate the retired old roof unless she elects to treat the roof retirement as a partial disposition of the building.

Replacing a substantial portion of any major component of a building meets the criteria of a capital improvement. One of the issues on its radar is the partial disposition election for buildings and its structural components. Treasury regulations provide guidelines for recognizing gain or loss on the disposition of macrs property as well as rules for the partial dispositions of assets regs. This can lead to situations in which a taxpayer performs the removal of the old property in year 1 while the project is not completed and the improvement is not placed into service until year 2 or later.

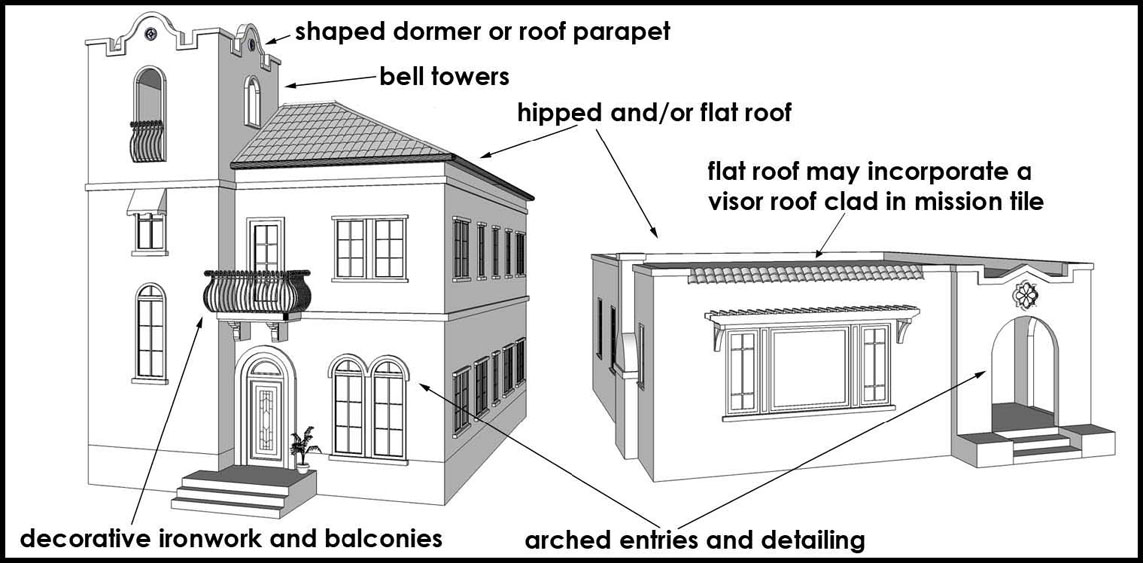

A roof system includes a roof structure and multiple layers of materials above it.